Mobilizing Banking Whenever, Wherever

MOBILE + RETAIL

To create a breakthrough and deliver truly helpful banking, small tweaks to a bank’s service, while useful, are not enough. In a rapidly shifting set of behaviors, the service model needed to change. Managing one’s finance needs to be rethought without adding any extra effort to the process. It needs to add value without a cost. It needs to relocate the center of banking from being anchored on the bank’s side to one that’s centered with customers, whenever they need to bank and wherever they are.

The Shifting Center Of Banking

With the rising numbers of money disruptors—Apple Pay, Square Cash, Venmo, Prism, Abra—how people bank is continuously evolving. Today, they rely less on physically going to a branch to do their banking. Instead, they’ve opted to bank digitally via desktop or mobile. Many banks have launched new services that make it easier to access funds, make payments, or manage a budget. Yet none of them have created a service that fundamentally changes the way people bank in today’s environment.

To be ‘more than a good bank’, the Royal Bank of Scotland’s (RBS) NatWest brand of banks needed to offer a breakthrough level of service. They needed to do more than their customers expect by revisiting their core services. They needed to reinvent how services and products are utilized by approaching them first from the customer’s point-of-view vs. from the bank’s operational position.

It should be about stabilizing and simplifying access, mediating pathways and programs, supporting new behaviors, and communicating directly instead of marketing to them. It’s about critically rethinking the mobile and online banking experience to help shape people’s everyday habits and rituals.

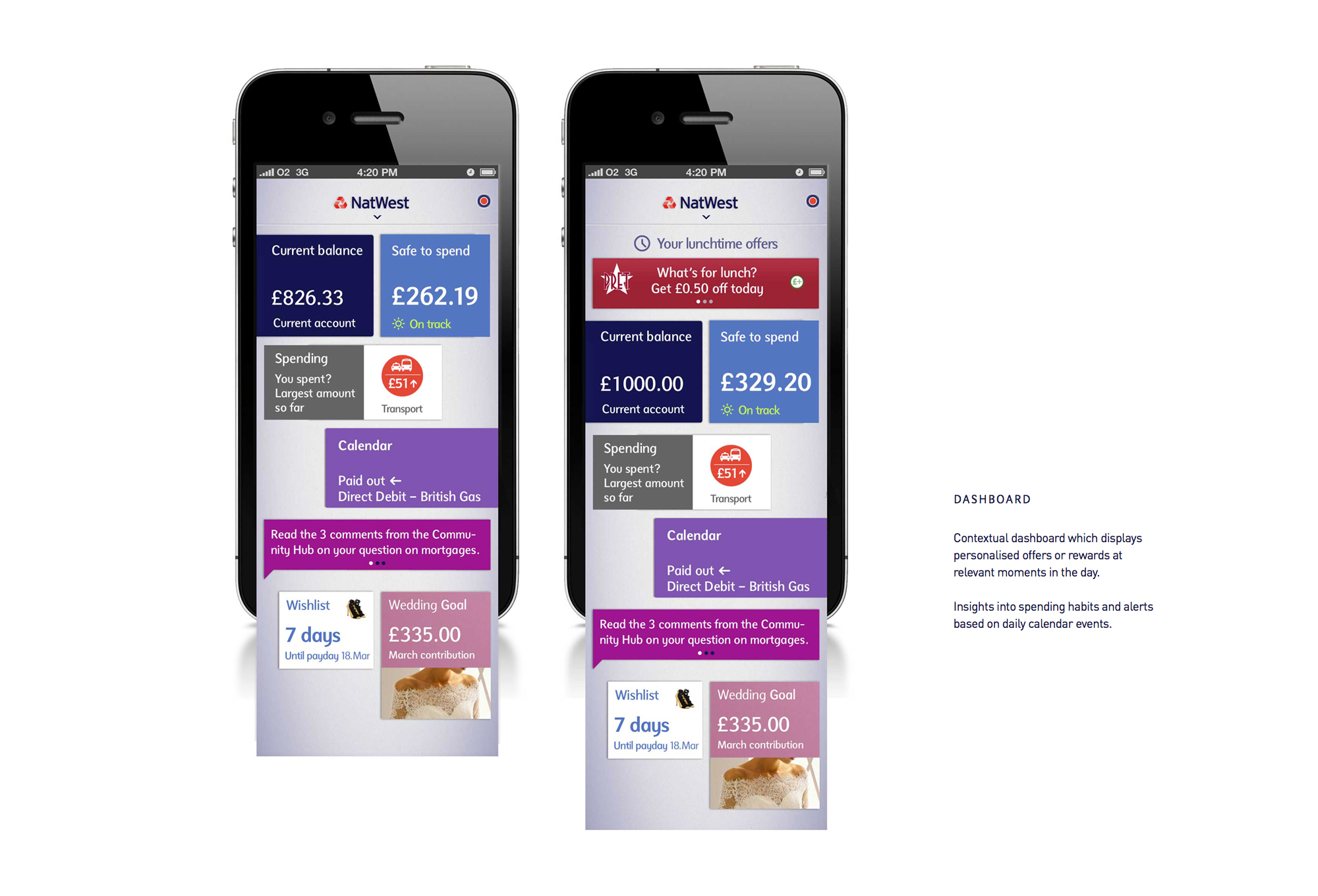

One pivotal area to address are the gaps in decision-making that affect people’s abilities to confidently bank at those urgent moments. By offering people complete views into their monetary positions, they can determine their financial capacity quickly; while being served timely financial options to help them achieve their goals.

By building services on everyday situations like this—around people’s behavioral and attitudinal positions—banks can begin constructing an experience framework that surpasses expectations and successfully transforms what banking is for the 21st century.

Mobilizing Banking Whenever, Wherever

Design Principles

Iterative projects benefit from design principles to guide and focus its evolution.

– Be More Like Our Customers

– Be Relevant

– Be Simple

– Be Memorable

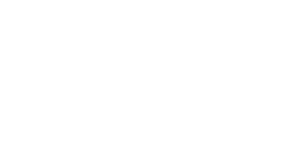

Tablet Solution

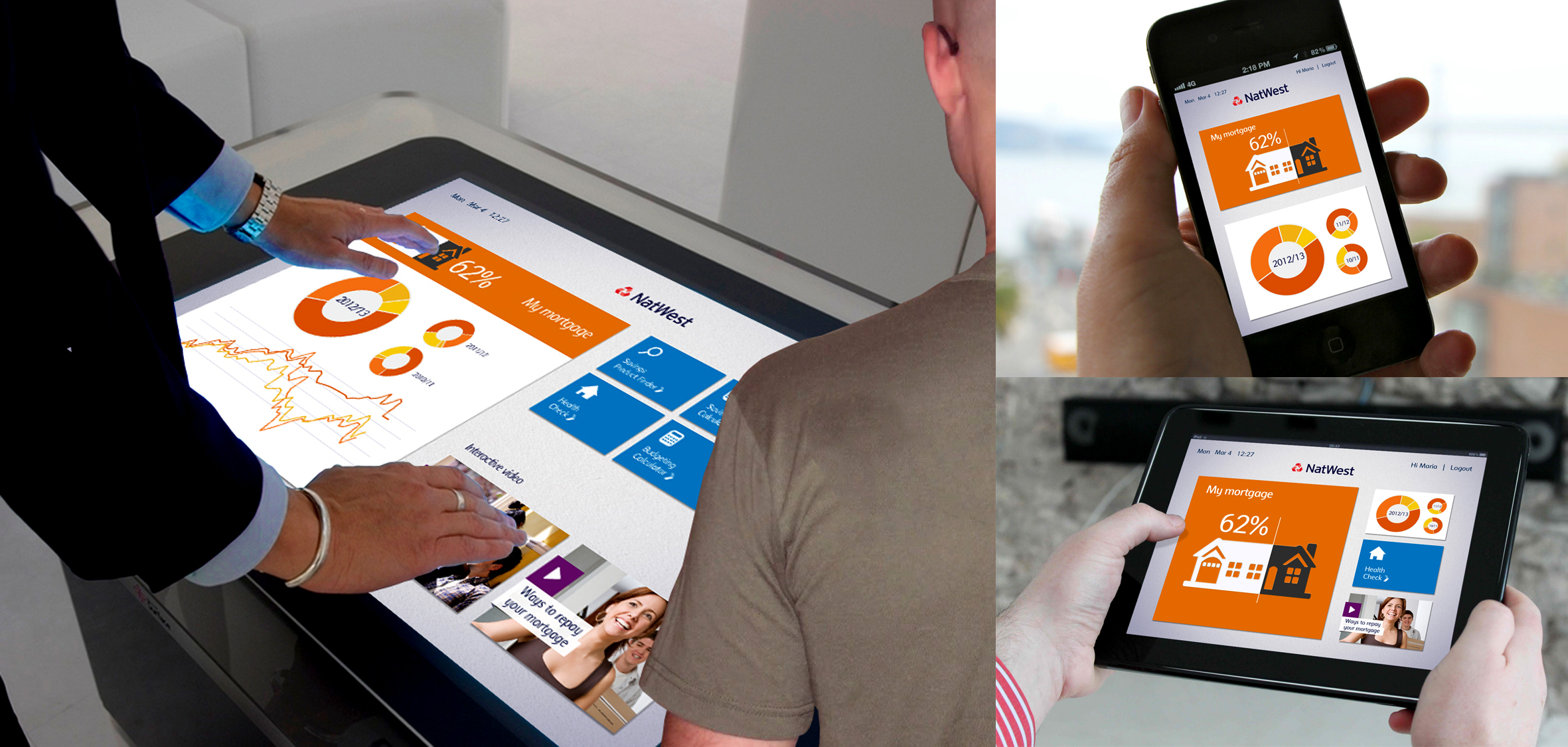

Customers need to be given insights into their finances that motivate them into taking action. The tablet experience provides a clearer view of a customer’s account and their financial trajectory: where they’ve spent their money, what they’ve spent it on and where they’re going. It helps them ignore the noise and focus on the important things, while implicitly encouraging them to think about making decisions and effecting change.

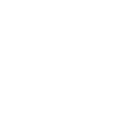

Mobile Solution

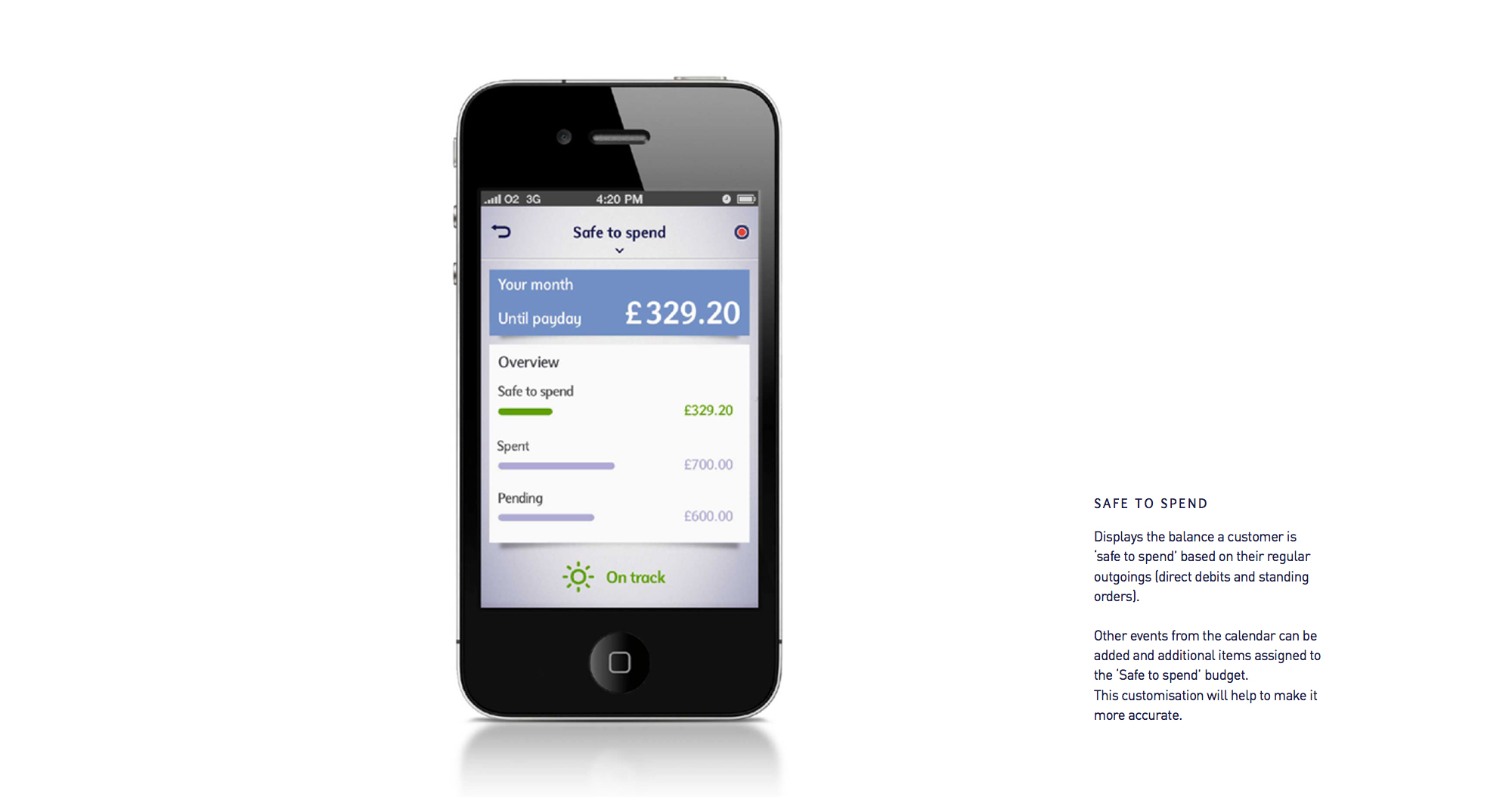

RBS/NatWest customers should be rewarded by the retailers they visit most often, and the brands who benefit most from their regular shopping habits. This is achieved by offering customers programs like cashback or vouchers for everything they spend on their debit card in participating retailers. There are benefits for all. Customers get to enjoy their lifestyle for less. Retailers get new customers and a stronger connection with repeat customers. And RBS/NatWest drives use of, and loyalty to, the debit card.

Around The Clock Banking

Connected Retail

For some people, a bank’s physical location offer a sense of comfort associated with stability and access. There are instances when complex money matters are best addressed face-to-face with bank representatives. By seamlessly connecting the retail experience with the tablet/mobile platform, bank branches become support centers that reciprocates value for both customers and the bank, fortifying trust for the brand.

/ Mobile / Retail

CATEGORY

Art / Design Direction, Branding, Creative Direction, Experience Design-UX/UI, Mobile, Apps / Platforms, Solution Strategy / Concept